Top 10 College Loan Providers

By Richard "Rick" Callahan | Published: 2025-03-20 | Category: College Loan Options For Students

About College Loan Options For Students

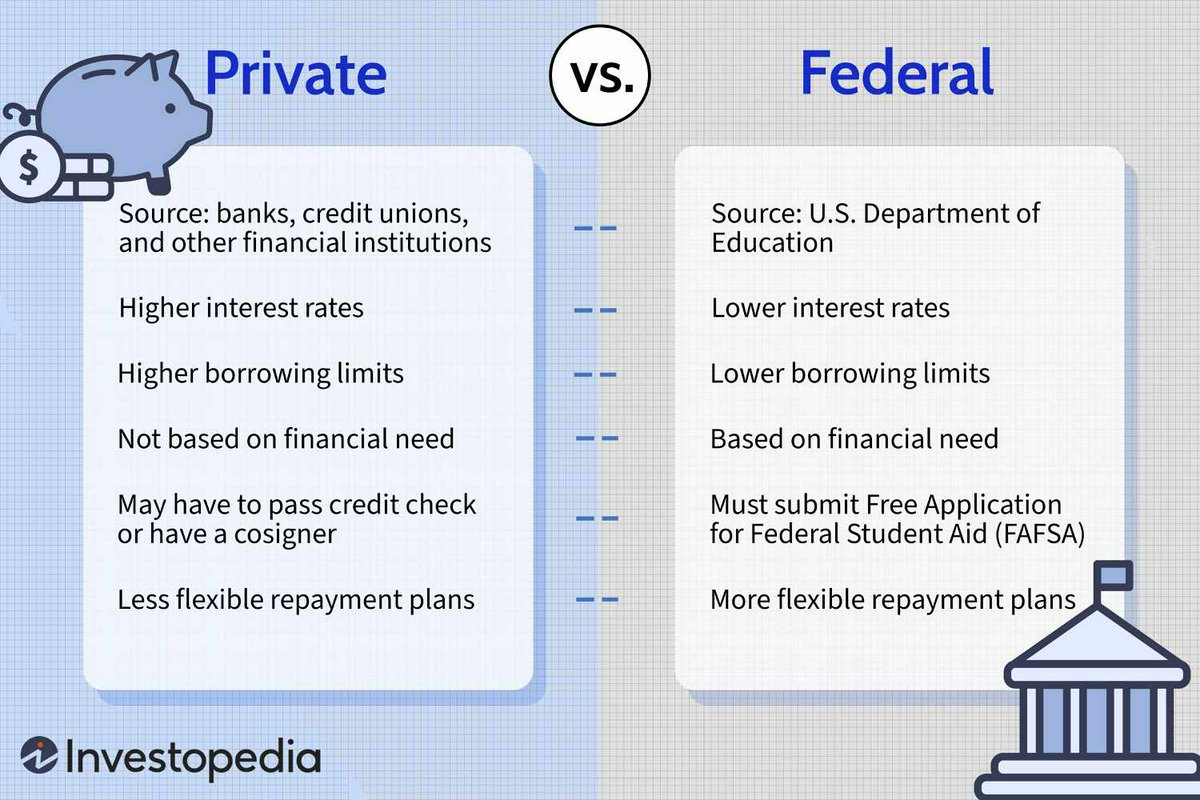

Provides financial aid options for students pursuing higher education, covering tuition, fees, and living expenses through various loan types. These loans help bridge the gap between educational costs and available resources like savings, scholarships, and federal aid.

How We Evaluated

Providers were evaluated based on interest rates (fixed/variable availability and competitiveness), repayment option flexibility, loan variety (undergraduate, graduate, parent, refinancing), customer service reputation, and unique borrower benefits.

Rating Criteria

- → Interest Rates

- → Repayment Options

- → Loan Variety

- → Customer Service

- → Borrower Benefits

The Best College Loan Options For Students

Credible

Visit Website →An online marketplace that allows borrowers to compare personalized loan offers from multiple lenders for student loans and refinancing.

Target Audience

Undergraduate Students, Graduate Students, Parents, Refinancing Borrowers

Service Offerings

Student Loan Marketplace

Compare prequalified rates for private undergraduate, graduate, and parent loans from various partner lenders.

- Shows fixed and variable rate options

Student Loan Refinancing Marketplace

Compare offers from multiple lenders to refinance existing student debt.

- Shows fixed and variable rate options

Scorecard (Overall: 7.2 / 10.0)

Pricing Model

Interest Rate

Displays potential APRs from partner lenders based on user input. Actual rates determined by the chosen lender.

Fees

Credible itself is free to use. Fees depend on the specific lender chosen through the platform.

Pros

- + Allows easy comparison of multiple lenders with one application

- + Prequalification check uses a soft credit pull

- + Streamlines the shopping process

- + Wide network of partner lenders

Cons

- - Is a marketplace, not a direct lender; final terms and service depend on the selected lender

- - Benefits vary significantly by lender chosen

Verdict

"An excellent tool for comparison shopping, helping borrowers efficiently find competitive rates from various private lenders without impacting their credit score initially."

PNC Bank

Visit Website →A national bank providing private student loan options for undergraduate, graduate, and health professional students.

Target Audience

Undergraduate Students, Graduate Students, Health Profession Students, Refinancing Borrowers

Service Offerings

PNC Solution Loan for Undergraduates

Funding for undergraduate education.

- Fixed and variable rates

- Cosigner generally recommended/required

PNC Solution Loan for Graduates

Loans for graduate and professional degrees.

- Fixed and variable rates

PNC Solution Loan for Health Professions

Specific loan options for medical, dental, and other health students.

- Deferred repayment options

Refinance Loans

Consolidate existing student debt.

- Fixed and variable rates

Scorecard (Overall: 7.0 / 10.0)

Pricing Model

Interest Rate

Offers fixed and variable APRs. Discounts available for autopay. Check website for current ranges.

Fees

No application or origination fees.

Pros

- + Co-signer release option available after 48 months of on-time payments

- + Rate discounts for automatic payments

- + Offered by a large, established bank

Cons

- - Co-signer release requires a long period of payments (48 months)

- - Website may be less intuitive than some fintech lenders

Verdict

"A dependable choice from a major bank, offering standard loan products with the potential for rate discounts and co-signer release."

User Reviews

Add Your Review

Loading reviews...

Citizens Bank

Visit Website →A large regional bank offering private student loans and refinancing options, including a multi-year approval feature.

Target Audience

Undergraduate Students, Graduate Students, Parents, Refinancing Borrowers

Service Offerings

Student Loan

For undergraduate and graduate students.

- Fixed and variable rates

- Requires cosigner for most students

Parent Loan

For parents borrowing for their child's education.

- Fixed and variable rates

Student Loan Refinancing

Consolidate private and federal student loans.

- Fixed and variable rates

Scorecard (Overall: 7.0 / 10.0)

Pricing Model

Interest Rate

Offers fixed and variable APRs. Potential loyalty and automatic payment discounts. Check website for current ranges.

Fees

No application or origination fees.

Pros

- + Multi-Year Approval option simplifies future borrowing

- + Potential rate discounts for existing bank customers

- + Co-signer release available after 36 consecutive on-time payments

Cons

- - Co-signer release requires a significant number of payments

- - May not be available in all states (primarily focused on specific regions, but offers online nationwide)

Verdict

"A reliable option from an established bank, especially appealing for families planning to borrow over multiple years due to the multi-year approval feature."

User Reviews

Add Your Review

Loading reviews...

SoFi

Visit Website →A financial technology company offering a range of financial products, including private student loans and refinancing, known for member benefits.

Target Audience

Undergraduate Students, Graduate Students, Parents, Refinancing Borrowers

Service Offerings

Undergraduate Student Loans

Loans for students seeking bachelor's or associate's degrees.

- Fixed and variable rates

Graduate Student Loans

Funding for master's, doctoral, MBA, Law, and Health Profession degrees.

- Fixed and variable rates

Parent Loans

Allows parents to borrow for their child's education.

- Fixed and variable rates

Student Loan Refinancing

Consolidate existing private and federal student loans.

- Fixed and variable rates

Scorecard (Overall: 7.8 / 10.0)

Pricing Model

Interest Rate

Competitive fixed and variable APRs. Check website for current ranges.

Fees

No origination fees, late fees, or prepayment penalties.

Pros

- + Extensive member benefits (career coaching, networking events, financial planning tools)

- + No fees charged

- + Offers loans for various degree types

- + Rate check with soft credit pull

Cons

- - Often requires strong credit or a qualified cosigner

- - Historically stronger focus on refinancing

Verdict

"A great option for borrowers with good credit who value added benefits like career services and community resources alongside competitive rates."

User Reviews

Add Your Review

Loading reviews...

Earnest

Visit Website →A fintech lender offering private student loans and refinancing with a focus on flexible repayment options and a strong digital experience.

Target Audience

Undergraduate Students, Graduate Students, Refinancing Borrowers

Service Offerings

Undergraduate Private Student Loans

Funding for bachelor's or associate's degrees.

- Fixed and variable rates

- Multiple repayment options

Graduate Private Student Loans

Loans for advanced degrees.

- Fixed and variable rates

- Covers various professional programs

Student Loan Refinancing

Consolidate existing student debt.

- Fixed and variable rates

- Rate check with soft credit pull

Scorecard (Overall: 7.8 / 10.0)

Pricing Model

Interest Rate

Offers competitive fixed and variable APRs. Check website for current ranges.

Fees

No origination, application, or prepayment fees.

Pros

- + Longer grace period (9 months) than many private lenders

- + Flexible repayment: option to skip one payment per year

- + Rate check without hard credit inquiry

- + No fees

Cons

- - Not available in all states

- - Requires good credit or a creditworthy cosigner

Verdict

"A strong contender known for its borrower-friendly features like the extended grace period and payment flexibility, ideal for tech-savvy borrowers."

User Reviews

Add Your Review

Loading reviews...

Ascent Student Loans

Visit Website →A student loan provider offering both traditional cosigned loans and unique non-cosigned options based on future income potential or academic merit.

Target Audience

Undergraduate Students, Graduate Students, DACA Students, International Students (with U.S. Cosigner)

Service Offerings

Cosigned Student Loans

Traditional loans requiring a creditworthy cosigner.

- Fixed and variable rates

- Available to wider range of students

Non-Cosigned Outcomes-Based Loan

Available to Juniors and Seniors without a cosigner based on factors like GPA and future income potential.

- Fixed and variable rates

- Stricter eligibility

Non-Cosigned Credit-Based Loan

Available to students who meet credit requirements without a cosigner.

- Fixed and variable rates

Scorecard (Overall: 7.6 / 10.0)

Pricing Model

Interest Rate

Offers fixed and variable APRs. Rates vary significantly between cosigned and non-cosigned options. Check website for current ranges.

Fees

No application or prepayment fees. Potential origination fee on certain non-cosigned loans.

Pros

- + Offers non-cosigned loan options for eligible upperclassmen

- + Potential 1% cash back graduation reward

- + Benefits like career coaching

- + Considers DACA students

Cons

- - Non-cosigned loans have stricter eligibility and potentially higher rates

- - Relatively new company compared to established banks

Verdict

"A standout choice for creditworthy upperclassmen seeking loans without a cosigner, offering unique outcomes-based underwriting."

User Reviews

Add Your Review

Loading reviews...

Discover Student Loans

Visit Website →Offered by the well-known financial services company, providing private student loans with borrower perks like cash rewards for good grades.

Target Audience

Undergraduate Students, Graduate Students, Professional Students (MBA, Health, Law), Parents, Residency/Bar Exam Borrowers

Service Offerings

Undergraduate Loans

Loans for students pursuing bachelor's or associate's degrees.

- Fixed and variable rates

Graduate Loans

Funding for various graduate and professional programs.

- Fixed and variable rates

Specialized Loans

Specific loans for Health Professions, Law, MBA, Residency, and Bar Exam costs.

- Tailored terms

Parent Loans

Allows parents to borrow to cover educational expenses.

- Fixed and variable rates

Scorecard (Overall: 7.8 / 10.0)

Pricing Model

Interest Rate

Offers fixed and variable APRs. Check website for current ranges.

Fees

No application, origination, or late fees.

Pros

- + Cash reward for good grades (typically 1% of loan amount)

- + No fees (application, origination, late, prepayment)

- + Covers up to 100% of school-certified costs

- + US-based loan specialists

Cons

- - No co-signer release option available while student is in school

- - Repayment options might be less flexible than some competitors

Verdict

"A solid no-fee option from a reputable brand, particularly appealing for students who perform well academically due to the cash reward."

User Reviews

Add Your Review

Loading reviews...

College Ave Student Loans

Visit Website →A fintech lender focused exclusively on student loans, known for flexible repayment options and a streamlined application process.

Target Audience

Undergraduate Students, Graduate Students, Parents, Refinancing Borrowers

Service Offerings

Undergraduate Student Loans

Funding for associate's and bachelor's degrees.

- Fixed and variable rates

- Multiple in-school repayment choices

Graduate Student Loans

Loans for master's, doctoral, and professional degrees.

- Fixed and variable rates

- Options for MBA, Medical, Law, Dental

Parent Loans

Allows parents to borrow for their child's education costs.

- Fixed and variable rates

Student Loan Refinancing

Combines existing federal and private loans into a new loan.

- Fixed and variable rates

Scorecard (Overall: 8.0 / 10.0)

Pricing Model

Interest Rate

Competitive fixed and variable APRs available. Check website for current ranges.

Fees

No origination fees or prepayment penalties.

Pros

- + Highly flexible repayment terms (choose loan length)

- + Variety of in-school repayment options

- + Quick online application process

- + Good customer service reputation

Cons

- - Shorter history than some competitors

- - Forbearance options may be less generous than federal loans

Verdict

"Excellent choice for borrowers seeking customized repayment plans and a modern, user-friendly experience."

User Reviews

Add Your Review

Loading reviews...

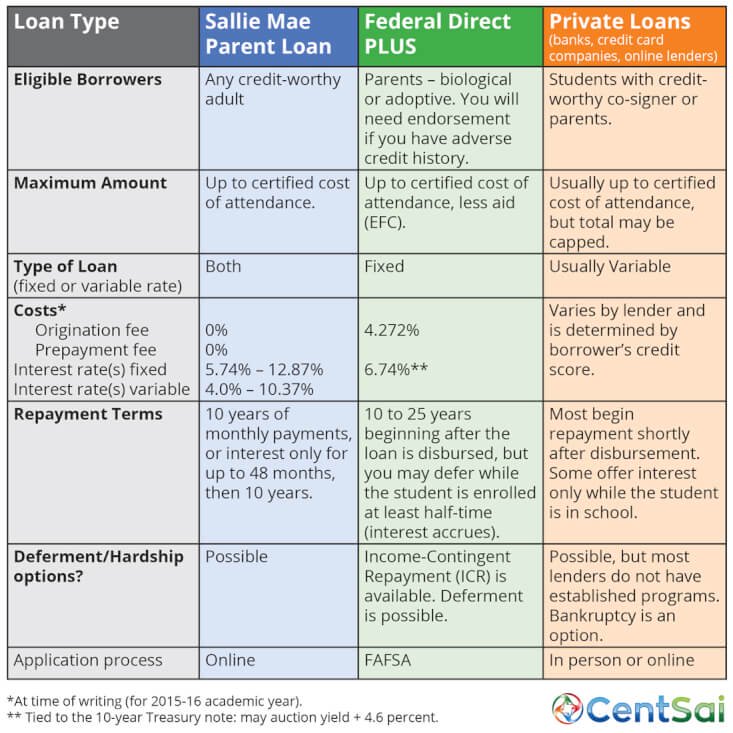

Sallie Mae

Visit Website →A major private student loan provider offering a wide range of loan products for various educational paths.

Target Audience

Undergraduate Students, Graduate Students, Professional Students (Medical, Dental, Law, MBA), Parents, Career Training Students

Service Offerings

Undergraduate Loans

Covers costs for bachelor's, associate's degrees.

- Fixed and variable rates

- Multiple repayment options

Graduate School Loans

Loans for master's and doctoral degrees.

- Fixed and variable rates

- Deferred repayment options

Specialized Graduate Loans

Specific loans for MBA, Medical, Dental, Law students.

- Tailored terms and rates

Parent Loans

Allows parents or other creditworthy individuals to borrow for a student's education.

- Fixed and variable rates

Scorecard (Overall: 7.6 / 10.0)

Pricing Model

Interest Rate

Offers both fixed and variable APRs. Rates depend on creditworthiness and loan terms. Check website for current ranges.

Fees

Generally no origination fees or prepayment penalties.

Pros

- + High loan limits (up to 100% of school-certified costs)

- + Co-signer release option available

- + Wide variety of loan types

- + Resources like scholarship search tools

Cons

- - No federal loan protections (like income-driven repayment)

- - Variable rates can increase

- - Co-signer release typically requires significant on-time payments

Verdict

"A strong private loan option with extensive loan choices and high limits, particularly good for those needing funding beyond federal caps."

User Reviews

Add Your Review

Loading reviews...

View Top Ranked Provider

Watch a short ad to unlock the details for the #1 ranked provider.

Federal Student Aid (U.S. Department of Education)

Visit Website →The primary source of federal financial aid for higher education in the United States, offering loans directly to students and parents.

Target Audience

Undergraduate Students, Graduate Students, Professional Students, Parents

Service Offerings

Direct Subsidized Loans

Need-based loans for undergraduates where the government pays interest during schooling and grace periods.

- Fixed interest rates

- Based on financial need

Direct Unsubsidized Loans

Non-need-based loans for undergraduate and graduate students; interest accrues during all periods.

- Fixed interest rates

- Not based on financial need

Direct PLUS Loans

Loans for graduate/professional students (Grad PLUS) and parents of dependent undergraduates (Parent PLUS).

- Fixed interest rates

- Credit check required

Direct Consolidation Loans

Combines multiple federal student loans into one single loan.

- Fixed interest rate based on weighted average

Scorecard (Overall: 8.4 / 10.0)

Pricing Model

Interest Rate

Fixed rates set annually by Congress. Varies by loan type and disbursement period.

Fees

Origination fees may apply, particularly for PLUS loans.

Pros

- + Fixed interest rates

- + Income-driven repayment plans

- + Potential for loan forgiveness programs

- + No credit check for most student loans (except PLUS)

- + Deferment and forbearance options

Cons

- - Strict annual and aggregate borrowing limits

- - Origination fees on PLUS loans

- - Customer service managed by third-party servicers can vary

Verdict

"The essential starting point for student borrowers due to unparalleled repayment flexibility and borrower protections, despite borrowing limits."

User Reviews

Add Your Review

Loading reviews...

Final Recommendation

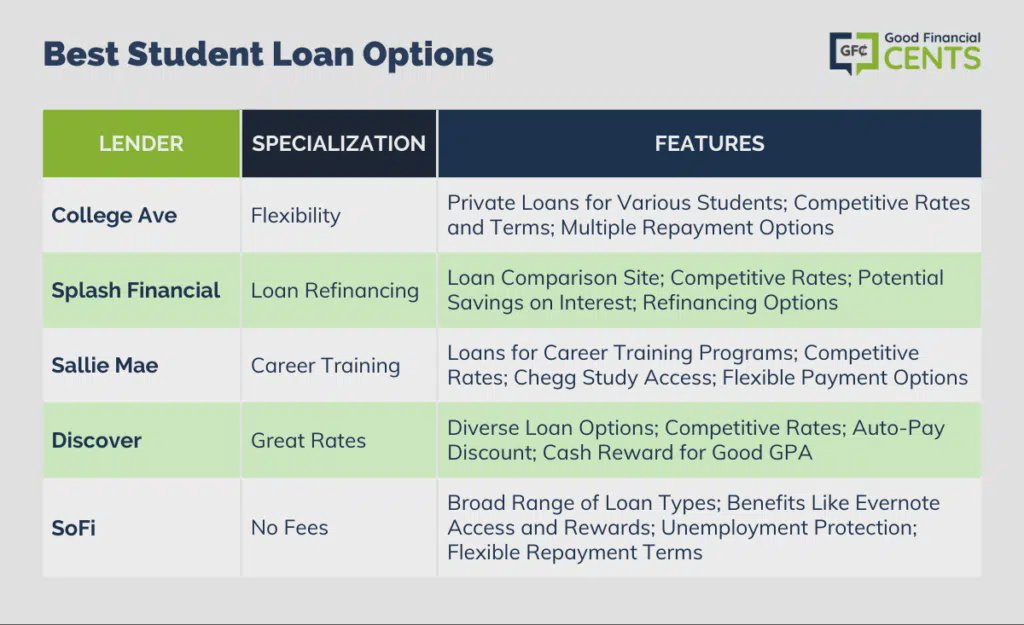

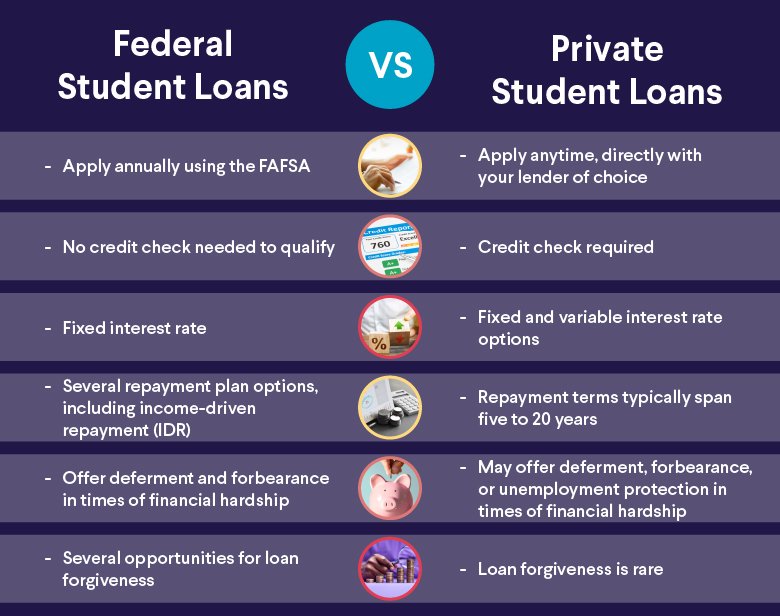

Choosing a student loan requires careful consideration of interest rates, repayment terms, and borrower protections. Federal loans offer unique benefits and should generally be prioritized. Private lenders provide options to cover remaining costs, with varying rates, terms, and perks; comparing multiple private offers is crucial.

User Reviews

Add Your Review

Loading reviews...

No reviews yet. Be the first to share your thoughts!