Top 10 Credit Card Providers

By Amanda Reyes | Published: 2025-04-09 | Category: Credit Cards

About Credit Cards

Credit cards are payment cards issued to users (cardholders) enabling them to pay a merchant for goods and services based on the cardholder's accrued debt. Issuers grant a line of credit, allowing cardholders to borrow money for payment, typically requiring repayment plus applicable interest and fees.

How We Evaluated

Providers were evaluated based on their range of card offerings, rewards program value, fee structures, customer service reputation, and digital platform usability. Scores reflect a composite assessment across these key criteria.

Rating Criteria

- → Card Variety & Features

- → Rewards Program Value

- → Fees & Rates

- → Customer Service & Reputation

- → Digital Tools & Accessibility

The Best Credit Cards

Synchrony Bank

Visit Website →A leading issuer of private label and co-branded credit cards for numerous retailers and brands, also offering some general-purpose cards.

Target Audience

Retail Shoppers, Consumers seeking store-specific financing/rewards, Users across various credit levels (depending on card)

Service Offerings

Retail Co-Branded Cards

Vast portfolio of cards partnered with specific retailers.

- Examples: Lowe's, Amazon, PayPal, Sam's Club, Verizon

General Purpose Cards

Fewer offerings, but includes some cashback and travel options.

- Synchrony Premier World Mastercard

Healthcare Financing

CareCredit card for healthcare expenses.

- CareCredit

Scorecard (Overall: 2.6 / 5.0)

Pricing Model

Annual Fee

Often $0 for store cards, varies for general purpose

APR

Variable, often high standard APRs, especially on retail cards; promotional financing common.

Deferred Interest

Common on promotional financing offers with store cards (interest accrues from purchase date if balance isn't paid in full by promo end)

Pros

- + Wide availability of store-specific credit cards

- + Often provides access to special financing offers at retailers

- + Partnerships with major brands

Cons

- - High standard APRs are common

- - Deferred interest promotions can be costly if not managed carefully

- - Rewards typically tied to specific stores/brands

- - Customer service primarily focused on individual card programs

Verdict

"Primarily serves consumers looking for financing or rewards at specific retailers. While useful for targeted spending, be cautious of high standard APRs and deferred interest terms."

Wells Fargo

Visit Website →A major national bank offering various consumer credit cards, including cashback, rewards points, and balance transfer options, with recent efforts to revamp its portfolio.

Target Audience

Broad Consumer Base, Existing Wells Fargo Customers, Cashback Seekers

Service Offerings

Cash Back Cards

Cards offering flat-rate or category-based cash back.

- Active Cash Card, Autograph Card

Points Rewards Cards

Cards earning points redeemable for various options.

- Autograph Card (earns points equivalent to cashback)

Balance Transfer / Low Interest Cards

Cards focused on introductory APR offers.

- Reflect Card

Secured Cards

Helps individuals build or rebuild credit.

- Wells Fargo Secured Credit Card

Scorecard (Overall: 3.4 / 5.0)

Pricing Model

Annual Fee

Mostly $0 annual fee options currently emphasized

APR

Variable, based on creditworthiness

Balance Transfer Fee

Typically 3% or 5% of transfer amount

Foreign Transaction Fee

Varies by card, often 3%

Pros

- + Simple and competitive cashback cards (Active Cash)

- + No annual fees on several core cards

- + Integration with Wells Fargo banking services

- + Introductory APR offers available

Cons

- - Rewards program lacks the depth and transfer partners of competitors like Chase/Amex

- - Recent history of regulatory issues impacts overall reputation

- - Limited premium card options

Verdict

"Offers solid, straightforward cashback and introductory APR cards, particularly appealing for existing Wells Fargo customers. However, its rewards ecosystem is less developed than top-tier issuers."

User Reviews

Add Your Review

Loading reviews...

Bank of America

Visit Website →One of the largest US banks, offering a wide range of credit cards with rewards often enhanced for customers with existing banking and investment relationships (Preferred Rewards program).

Target Audience

Broad Consumer Base, Existing BofA Customers, Cashback Seekers, Travelers, Students, Credit Builders

Service Offerings

Cash Rewards Cards

Offers cash back, often with customizable bonus categories.

- Customized Cash Rewards Credit Card

Travel Rewards Cards

Points-based cards for travel.

- Travel Rewards Credit Card, Premium Rewards Credit Card

Simple Rewards

Cards with straightforward rewards structures.

- Unlimited Cash Rewards Credit Card

Secured & Student Cards

Options for those new to credit or rebuilding.

- BankAmericard Secured, Customized Cash Rewards for Students

Balance Transfer Cards

Cards featuring introductory APR offers.

- BankAmericard Credit Card

Scorecard (Overall: 3.6 / 5.0)

Pricing Model

Annual Fee

Varies (many $0 options, premium up to $95)

APR

Variable, based on creditworthiness

Balance Transfer Fee

Typically 3% of transfer amount

Foreign Transaction Fee

Typically 3%, waived on some travel cards

Pros

- + Preferred Rewards program significantly boosts rewards for eligible banking clients

- + Wide selection of cards, including student and secured options

- + Customizable cash back category choice

- + Strong digital banking integration

Cons

- - Rewards value is significantly lower without Preferred Rewards status

- - Customer service experiences can vary

- - Less competitive premium travel card compared to Chase/Amex

Verdict

"A solid choice, especially advantageous for existing Bank of America customers who qualify for the Preferred Rewards program, which elevates the value of their card offerings significantly."

User Reviews

Add Your Review

Loading reviews...

U.S. Bank

Visit Website →A large regional bank offering a variety of credit cards, known for its customizable cashback categories and premium travel rewards card.

Target Audience

Broad Consumer Base, Category Spenders, Travelers, Businesses

Service Offerings

Customizable Cash Back

Allows cardholders to choose bonus cashback categories.

- U.S. Bank Cash+ Visa Signature Card

Travel Rewards Cards

Points-based cards for travel, including a premium option.

- U.S. Bank Altitude Go Visa Signature Card, U.S. Bank Altitude Connect Visa Signature Card, U.S. Bank Altitude Reserve Visa Infinite Card

Simple Rewards Cards

Straightforward points or cashback earning.

- U.S. Bank Altitude Go, U.S. Bank Cash+

Secured Cards

Options for building or rebuilding credit.

- U.S. Bank Secured Visa Card

Business Cards

Variety of cards for business owners.

- U.S. Bank Business Triple Cash Rewards World Elite Mastercard

Scorecard (Overall: 3.8 / 5.0)

Pricing Model

Annual Fee

Varies (from $0 to $400)

APR

Variable, based on creditworthiness

Balance Transfer Fee

Typically 3% of transfer amount

Foreign Transaction Fee

Often 3%, waived on travel cards

Pros

- + Excellent customizable cashback categories (Cash+)

- + Strong premium travel card (Altitude Reserve)

- + Good range of card options including secured

- + Mobile payment rewards on Altitude Reserve

Cons

- - Less brand prominence in the credit card space compared to giants

- - Customer service can be inconsistent

- - Altitude Reserve requires existing U.S. Bank relationship

Verdict

"A strong provider, especially notable for the Cash+ card allowing users to maximize rewards in chosen spending categories and the competitive Altitude Reserve for travel."

User Reviews

Add Your Review

Loading reviews...

Citi Cards

Visit Website →A division of Citigroup, offering a diverse portfolio of credit cards featuring the ThankYou Rewards program, strong balance transfer options, and co-branded partnerships.

Target Audience

Good to Excellent Credit, Balance Transfer Seekers, Cashback Earners, Travelers (esp. American Airlines)

Service Offerings

ThankYou Rewards Cards

Cards earning points in Citi's flexible ThankYou Rewards program.

- Citi Premier Card, Citi Rewards+ Card

Cash Back Cards

Includes unique flat-rate cashback structures.

- Citi Double Cash Card, Citi Custom Cash Card

Travel Co-Branded Cards

Primary partnership is with American Airlines.

- Citi / AAdvantage Platinum Select World Elite Mastercard, Citi / AAdvantage Executive World Elite Mastercard

Balance Transfer Cards

Known for long introductory 0% APR periods on balance transfers.

- Citi Simplicity Card, Citi Diamond Preferred Card

Business Cards

Cards tailored for business needs.

- CitiBusiness / AAdvantage Platinum Select Mastercard

Scorecard (Overall: 3.8 / 5.0)

Pricing Model

Annual Fee

Varies (from $0 to $450+)

APR

Variable, based on creditworthiness

Balance Transfer Fee

Typically 3% or 5% of transfer amount

Foreign Transaction Fee

Typically 3%, waived on some travel/premium cards

Pros

- + Excellent balance transfer offers (long 0% APR periods)

- + Strong cashback cards (Double Cash, Custom Cash)

- + Flexible ThankYou Rewards points program

- + Good co-branded options (especially American Airlines)

Cons

- - Customer service reputation is sometimes criticized

- - ThankYou Rewards program can be less intuitive than competitors

- - Website/app usability perceived as slightly less refined than Chase/Amex

Verdict

"A solid choice, particularly strong for consumers seeking lengthy balance transfer periods or innovative cashback structures. The ThankYou points system offers good value, especially for travel."

User Reviews

Add Your Review

Loading reviews...

Capital One

Visit Website →A major bank holding company offering a broad range of credit cards known for straightforward rewards (miles and cash back), travel benefits, and options for various credit levels.

Target Audience

Wide Range (Excellent to Fair/Building Credit), Travelers, Cashback Seekers, Students, Businesses

Service Offerings

Travel Miles Cards

Cards earning miles redeemable for travel, often with simple structures.

- Venture X Rewards, Venture Rewards, VentureOne Rewards

Cash Back Cards

Cards offering cash back, some with bonus categories.

- Savor Rewards, SavorOne Rewards, Quicksilver Rewards, QuicksilverOne Rewards

Student Cards

Cards tailored for students building credit.

- SavorOne Student Rewards, Quicksilver Student Rewards

Secured Cards

Helps individuals establish or rebuild credit.

- Platinum Secured, Quicksilver Secured Rewards

Business Cards

Cards designed for business spending.

- Spark Miles, Spark Cash Select

Scorecard (Overall: 3.8 / 5.0)

Pricing Model

Annual Fee

Varies by card (many $0 options, premium up to $395)

APR

Variable, based on creditworthiness

Balance Transfer Fee

Typically 3% or 4% fee applies

Foreign Transaction Fee

$0 on most cards

Pros

- + Wide range of cards for different credit profiles

- + Simple and easy-to-understand rewards programs

- + No foreign transaction fees on most cards

- + Good travel cards (Venture line)

- + Offers secured and student cards

- + Decent digital tools (app, website)

Cons

- - Customer service reputation can be mixed

- - Rewards program less flexible than Chase/Amex for transfers

- - Capital One pulls inquiries from all 3 credit bureaus for applications

Verdict

"A strong contender with straightforward rewards and cards accessible to a wide range of consumers, including those building credit. Particularly good for simple travel rewards and avoiding foreign transaction fees."

User Reviews

Add Your Review

Loading reviews...

Navy Federal Credit Union

Visit Website →The largest credit union in the United States, serving the military, veterans, Department of Defense personnel, and their families with member-focused financial products, including competitive credit cards.

Target Audience

Military Members (Active Duty, Retired, Veterans), Department of Defense Personnel, Family Members of Eligible Individuals

Service Offerings

Rewards Cards

Cards offering points or cash back on purchases.

- Navy Federal More Rewards American Express Card, Navy Federal cashRewards Card

Travel Rewards Cards

Cards focused on travel benefits and points.

- Navy Federal Flagship Rewards Card

Low APR / Balance Transfer Cards

Cards offering lower interest rates or introductory balance transfer offers.

- Navy Federal Platinum Card

Secured Cards

Card designed to help build or repair credit.

- Navy Federal nRewards Secured Card

Scorecard (Overall: 4.0 / 5.0)

Pricing Model

Annual Fee

Often $0 or lower than comparable bank cards

APR

Generally lower variable APRs compared to major banks

Balance Transfer Fee

Often $0

Foreign Transaction Fee

Often $0 on many cards

Pros

- + Highly competitive low APRs and fees

- + Excellent member service

- + No balance transfer fees on many cards

- + No foreign transaction fees on many cards

- + Member-focused approach

- + Offers secured card option

Cons

- - Membership eligibility is restricted to the military community and their families

- - Rewards programs may be less robust than top-tier bank issuers

Verdict

"An outstanding choice for eligible military members and their families, offering exceptional value through low fees, competitive rates, and strong customer service."

User Reviews

Add Your Review

Loading reviews...

Discover Financial Services

Visit Website →Known for its customer-friendly approach, US-based customer service, and strong cashback rewards programs, often with no annual fees.

Target Audience

Good to Excellent Credit, Cashback Seekers, Students, Credit Builders, Balance Transfer Seekers

Service Offerings

Cash Back Cards

Flagship cards offer rotating bonus categories or flat-rate cash back.

- Discover it Cash Back, Discover it Miles, Discover it Chrome

Student Cards

Cards designed for college students, often with rewards and credit-building features.

- Discover it Student Cash Back, Discover it Student Chrome

Secured Cards

Helps individuals build or rebuild credit history, offers cashback rewards.

- Discover it Secured Credit Card

Balance Transfer Cards

Cards featuring introductory 0% APR periods on balance transfers.

- Discover it Balance Transfer

Scorecard (Overall: 4.2 / 5.0)

Pricing Model

Annual Fee

Typically $0 on most cards

APR

Variable, based on creditworthiness

Balance Transfer Fee

Typically 3% or 5% introductory/standard fee

Foreign Transaction Fee

$0 on all cards

Pros

- + Excellent US-based customer service

- + Generally no annual fees

- + Good cashback rewards programs

- + No foreign transaction fees

- + Offers cards for students and credit building

- + Free FICO score access

Cons

- - Lower acceptance internationally compared to Visa/Mastercard

- - Limited premium travel perks compared to Amex/Chase

- - Smaller card portfolio variety

Verdict

"A top choice for consumers prioritizing excellent customer service, straightforward cashback rewards, and no annual fees. Particularly strong for students and those seeking value."

User Reviews

Add Your Review

Loading reviews...

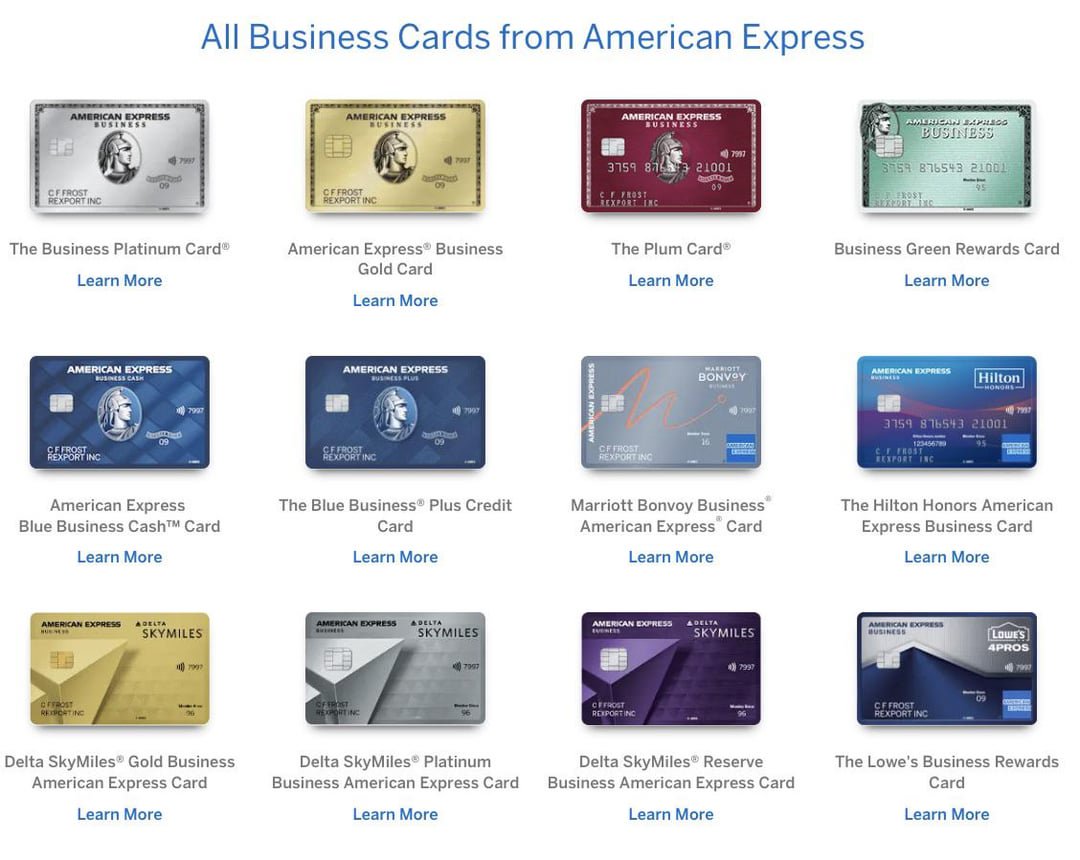

American Express

Visit Website →A global financial services corporation known for its premium credit and charge cards, focusing on travel rewards, exclusive perks, and strong customer service.

Target Audience

Excellent Credit, Frequent Travelers, High Spenders, Businesses, Reward Maximizers

Service Offerings

Membership Rewards Cards

Cards earning flexible points transferable to numerous airline/hotel partners.

- Platinum Card, Gold Card, Green Card

Cash Back Cards

Cards offering cash back on purchases.

- Blue Cash Preferred, Blue Cash Everyday

Travel Co-Branded Cards

Partnerships primarily with Delta Air Lines and Hilton Hotels.

- Delta SkyMiles Cards, Hilton Honors Cards

Business Cards

Range of charge and credit cards for businesses of all sizes.

- Business Platinum Card, Business Gold Card, Blue Business Plus

Charge Cards

Cards typically requiring payment in full each month.

- Platinum Card, Gold Card

Scorecard (Overall: 4.4 / 5.0)

Pricing Model

Annual Fee

Varies widely (from $0 to $695+)

APR

Variable on credit cards; Charge cards require payment in full

Foreign Transaction Fee

Often 0% on travel-focused cards

Pros

- + Industry-leading customer service

- + Excellent travel rewards and perks (lounges, credits)

- + Valuable Membership Rewards program

- + Premium card benefits

- + Strong digital tools and app

Cons

- - Higher annual fees on premium cards

- - Not as widely accepted internationally as Visa/Mastercard

- - Generally requires excellent credit

Verdict

"Ideal for frequent travelers and high spenders who value premium perks, excellent customer service, and a powerful rewards program, provided they meet the credit requirements and can justify the fees."

User Reviews

Add Your Review

Loading reviews...

View Top Ranked Provider

Watch a short ad to unlock the details for the #1 ranked provider.

#1

#1

Location: Wilmington, DE (Card Services HQ); New York, NY (JPMorgan Chase HQ) Get Directions

Founded: 1799

Chase Card Services

Visit Website →A leading credit card issuer and division of JPMorgan Chase, offering a wide array of cards known for valuable rewards points (Ultimate Rewards) and strong co-branded partnerships.

Target Audience

Good to Excellent Credit, Travel Enthusiasts, Cashback Seekers, Businesses, Balance Transfer Seekers

Service Offerings

Rewards Cards

Cards earning Ultimate Rewards points, highly valued for travel redemptions and transfers.

- Chase Sapphire Preferred, Chase Sapphire Reserve

Cash Back Cards

Cards offering straightforward cash back on purchases.

- Chase Freedom Unlimited, Chase Freedom Flex

Travel Co-Branded Cards

Partnerships with major airlines and hotels.

- United Airlines, Southwest Airlines, Marriott Bonvoy, Hyatt

Business Cards

Cards tailored for business expenses with relevant rewards.

- Ink Business Preferred, Ink Business Cash

Balance Transfer Cards

Cards offering introductory 0% APR periods on balance transfers.

- Chase Slate Edge

Scorecard (Overall: 4.6 / 5.0)

Pricing Model

Annual Fee

Varies by card (from $0 up to $550+)

APR

Variable, based on creditworthiness and Prime Rate

Balance Transfer Fee

Typically 3% or 5% of transfer amount

Foreign Transaction Fee

Often 0% on travel cards, 3% on others

Pros

- + Excellent rewards program (Ultimate Rewards)

- + Wide variety of card options

- + Strong co-branded partnerships (airlines, hotels)

- + User-friendly website and mobile app

- + Generous sign-up bonuses common

Cons

- - Typically requires good to excellent credit for approval

- - Some premium cards have high annual fees

Verdict

"Best overall provider due to its highly valuable and flexible Ultimate Rewards program, diverse card selection catering to various needs, and strong digital platforms."

User Reviews

Add Your Review

Loading reviews...

Final Recommendation

The credit card landscape offers diverse options, from premium travel rewards to straightforward cash back and credit-building tools. Top providers like Chase and American Express excel with valuable rewards programs and extensive perks, while Discover and Navy Federal stand out for customer service and value-oriented fees. Issuers like Capital One and Citi provide strong mid-tier options, and others cater to specific needs like retail financing or customizable rewards.

User Reviews

Add Your Review

Loading reviews...

No reviews yet. Be the first to share your thoughts!