Top 8 Payroll Services Compared

By Jordan Patel | Published: Current Evaluation Period | Category: Payroll Services

About Payroll Services

Payroll services automate the process of paying employees, including calculating wages, withholding taxes, and managing filings. They help businesses ensure accuracy, compliance, and timely payments.

Scoring Criteria

- → Core Payroll Accuracy

- → Tax Management

- → Ease of Use

- → HR & Benefits Integration

- → Reporting & Analytics

- → Customer Support

- → Pricing & Value

- → Scalability

The Best Payroll Services

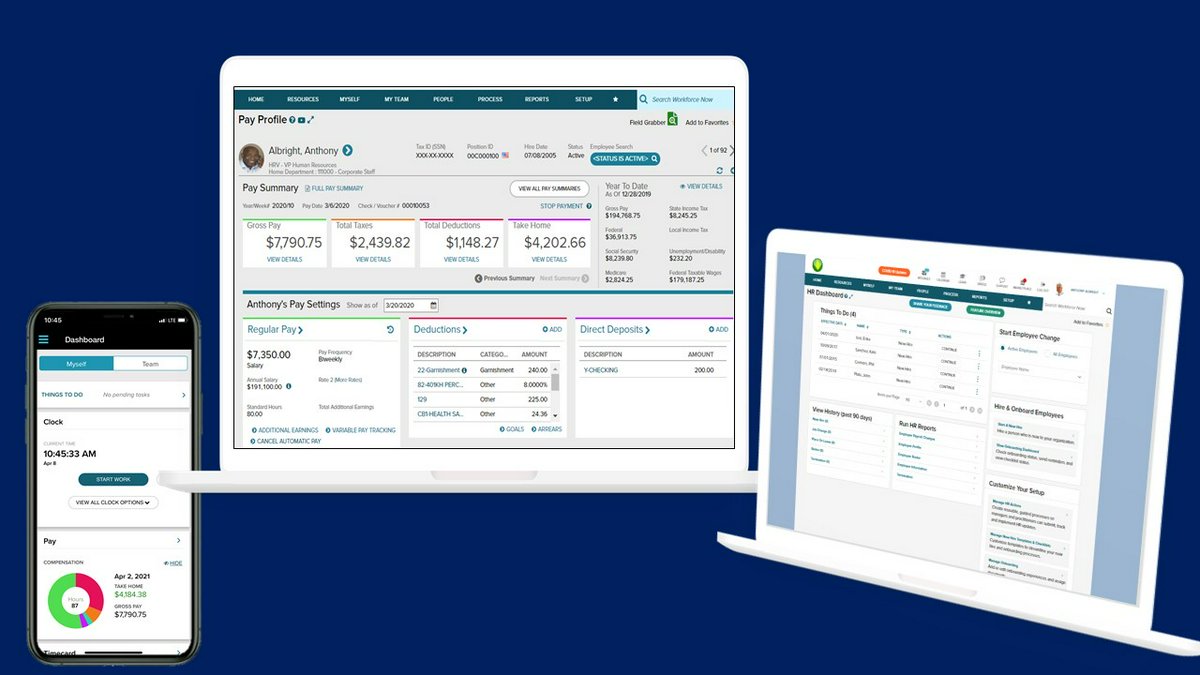

ADP RUN / Workforce Now

By ADP

Comprehensive payroll and HR platform scalable for businesses of all sizes, from small startups (RUN) to large enterprises (Workforce Now).

Platforms & Use Cases

Platforms: Web, Mobile (iOS/Android)

Best For: Small Business, Mid-size Business, Large Enterprise

Key Features

- ✓Automated Payroll Processing: Calculates wages, deductions, and net pay automatically.

- ✓Tax Filing & Compliance: Handles federal, state, and local tax calculations, filings, and payments.

- ✓HR Suite Integration: Offers integrated HR tools including hiring, onboarding, benefits administration, and time tracking depending on the platform version.

- ✓Reporting: Provides detailed payroll and HR reports.

- ✓Employee Self-Service: Portal for employees to view pay stubs, tax forms, and manage personal information.

Scorecard (Overall: 8.2 / 10.0)

Pricing

RUN (Small Business)

Contact Vendor

- Payroll

- Tax Filing

- Direct Deposit

- Basic HR Tools

Limitations: Advanced features require higher tiers

Workforce Now (Mid-Large)

Contact Vendor

- Advanced Payroll

- Full HR Suite

- Talent Management

- Benefits Admin

- Analytics

Limitations: Can be complex, Pricing not transparent

Pros

- + Highly scalable

- + Comprehensive feature set

- + Strong compliance support

- + Industry leader reputation

Cons

- - Pricing requires quote and can be high

- - Can be complex to navigate

- - Customer support experiences vary

Verdict

"A robust, scalable solution ideal for growing businesses needing comprehensive HR and payroll, but expect higher costs and complexity."

Gusto

By Gusto

User-friendly payroll, benefits, and HR platform primarily focused on small to medium-sized businesses.

Platforms & Use Cases

Platforms: Web, Mobile (iOS/Android)

Best For: Startups, Small Business, Medium Business

Key Features

- ✓Full-Service Payroll: Automated payroll runs, tax filings (W-2s, 1099s), and multiple pay rates/schedules.

- ✓Employee Onboarding: Streamlined digital onboarding process for new hires.

- ✓Benefits Administration: Integrated health benefits, 401(k)s, workers' comp, and commuter benefits.

- ✓Time Tracking Tools: Built-in time tracking and PTO management features.

- ✓HR Tools & Compliance: Offers HR resources, compliance assistance, and expert support options.

Scorecard (Overall: 8.2 / 10.0)

Pricing

Simple

$40.00 / Monthly + Per Employee Fee

- Payroll

- Employee Self-Service

- Basic Hiring

- Integrations

Limitations: Single state payroll only, Limited HR features

Plus

$80.00 / Monthly + Per Employee Fee

- Multi-state Payroll

- Next-day Direct Deposit

- Advanced Hiring & Onboarding

- Time Tracking

- PTO Management

Limitations: Dedicated support costs extra

Premium

Contact Vendor

- All Plus features

- Dedicated Support

- HR Resource Center

- Compliance Alerts

- Full Service Migration

Limitations: Highest cost

Pros

- + Exceptionally easy to use interface

- + Transparent pricing for lower tiers

- + Strong focus on employee experience

- + Good integration options

Cons

- - Can become expensive for larger teams

- - Reporting options less robust than enterprise solutions

- - Limited customization

Verdict

"Excellent choice for small to medium businesses prioritizing ease of use and a modern interface, offering solid payroll and HR features."

User Reviews

Add Your Review

Loading reviews...

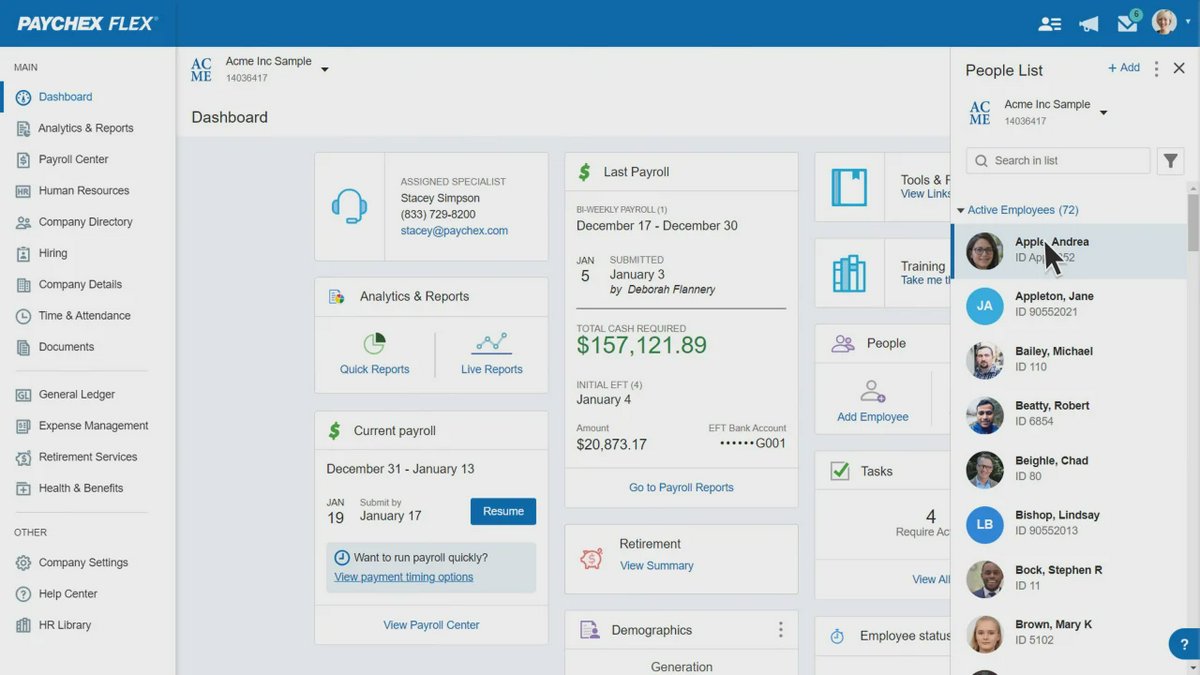

Paychex Flex

By Paychex

Scalable payroll and HR solution catering to businesses of various sizes, with strong compliance and support features.

Platforms & Use Cases

Platforms: Web, Mobile (iOS/Android)

Best For: Small Business, Mid-size Business, Large Enterprise

Key Features

- ✓Online Payroll: Processes payroll, handles direct deposit, and provides pay options.

- ✓Tax Services: Calculates, pays, and files federal, state, and local payroll taxes.

- ✓HR Administration: Includes tools for onboarding, employee records, performance management, and benefits administration.

- ✓Time & Attendance: Integrated time tracking solutions.

- ✓Compliance Support: Resources and support for navigating labor laws and regulations.

Scorecard (Overall: 8.0 / 10.0)

Pricing

Flex Essentials

$39.00 / Monthly + Per Employee Fee

- Payroll Processing

- Tax Services

- Direct Deposit

- Standard Reporting

- New Hire Reporting

Limitations: Basic HR features

Flex Select

Contact Vendor

- Essentials features

- Dedicated Payroll Specialist

- Check Signing

- Workers' Comp Report

Limitations: Pricing not public

Flex Pro

Contact Vendor

- Select features

- Employee Handbook Builder

- Onboarding

- SUI Service

- Background Checks

Limitations: Geared towards more complex needs

Pros

- + Scalable for business growth

- + Strong compliance focus

- + Dedicated support options available

- + Wide range of HR services

Cons

- - Pricing structure can be unclear and potentially high

- - Interface less intuitive than some competitors

- - Some features cost extra

Verdict

"A solid, scalable option particularly strong on compliance and support, suitable for businesses that anticipate growth and need robust HR."

User Reviews

Add Your Review

Loading reviews...

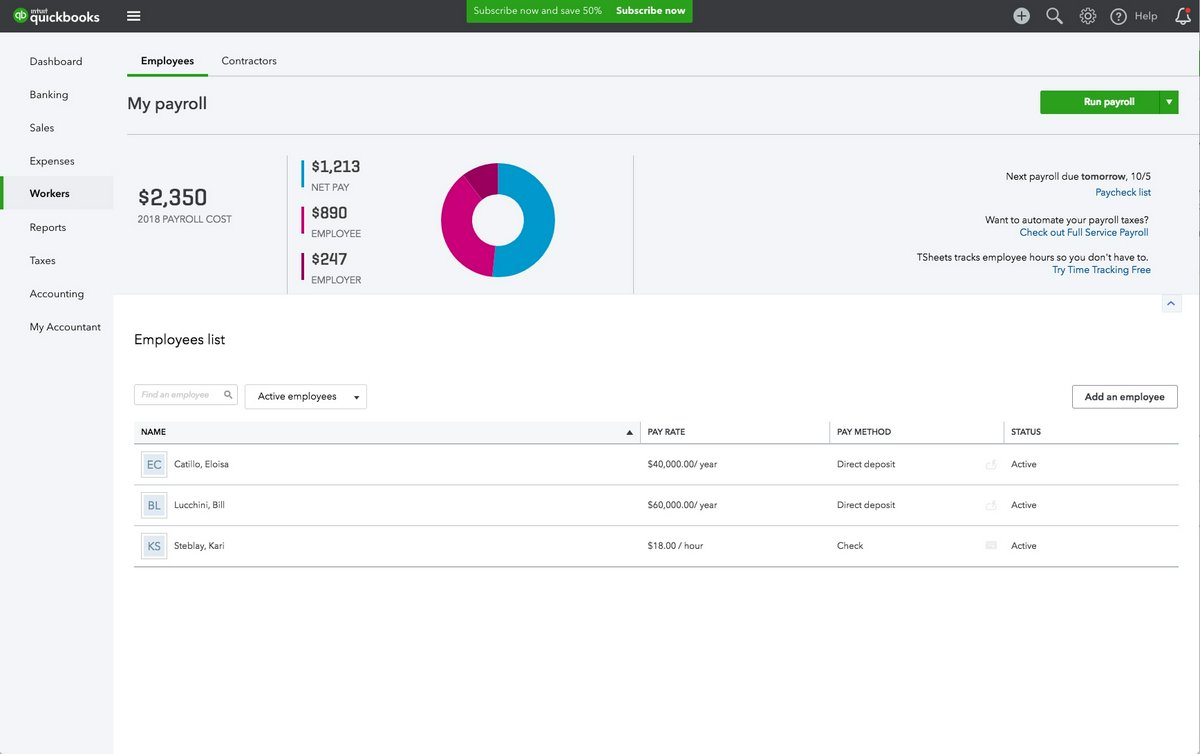

QuickBooks Payroll

By Intuit

Payroll solution integrated directly into the QuickBooks accounting ecosystem, ideal for existing QuickBooks users.

Platforms & Use Cases

Platforms: Web, Mobile (iOS/Android)

Best For: Small Business, QuickBooks Users

Key Features

- ✓Seamless QuickBooks Integration: Payroll data automatically syncs with QuickBooks accounting software.

- ✓Automated Payroll & Taxes: Calculates paychecks, pays employees via direct deposit, and handles payroll tax filings.

- ✓Multiple Pay Schedules: Supports various pay frequencies.

- ✓Time Tracking Integration: Connects with QuickBooks Time (formerly TSheets) for accurate hour tracking.

- ✓Basic HR Support: Offers access to HR advisors and compliance resources in higher tiers.

Scorecard (Overall: 7.2 / 10.0)

Pricing

Core

$45.00 / Monthly + Per Employee Fee

- Full-service payroll

- Automated taxes & forms

- Next-day direct deposit

Limitations: Basic support, No time tracking included

Premium

$80.00 / Monthly + Per Employee Fee

- Core features

- Same-day direct deposit

- Mobile time tracking

- HR support center

- Expert review

Limitations: Higher cost

Elite

$125.00 / Monthly + Per Employee Fee

- Premium features

- Onboarding

- Expert setup

- Tax penalty protection

- Personal HR advisor

Limitations: Most expensive tier

Pros

- + Excellent integration with QuickBooks

- + Relatively easy to use, especially for existing users

- + Automated tax handling

- + Transparent pricing

Cons

- - HR features less comprehensive than dedicated HR platforms

- - Best suited for small businesses already using QuickBooks

- - Support quality can be inconsistent

Verdict

"The go-to choice for small businesses already invested in the QuickBooks ecosystem, offering convenience and solid payroll features."

User Reviews

Add Your Review

Loading reviews...

Rippling

By Rippling

Unified workforce platform combining HR, IT, and Finance, including robust global payroll capabilities.

Platforms & Use Cases

Platforms: Web, Mobile (iOS/Android)

Best For: Tech Startups, Mid-size Business, Companies needing IT/HR integration, Global Workforce

Key Features

- ✓Global Payroll: Run payroll for employees and contractors across multiple countries.

- ✓Unified Platform: Combines Payroll, Benefits, HR, and IT management (device/app management) in one system.

- ✓Automated Workflows: Extensive customization for automating HR and IT tasks during onboarding/offboarding.

- ✓Time & Attendance: Integrated tools for tracking hours and managing PTO.

- ✓App Management: Provision and deprovision access to hundreds of third-party applications automatically.

Scorecard (Overall: 8.4 / 10.0)

Pricing

Core Platform

$8.00 / Monthly Per Employee (Base Fee)

- Employee management core

- Requires add-on modules like Payroll

Limitations: Base platform fee + per-module cost

Payroll Module

Contact Vendor

- Full-service US & Global Payroll

- Tax Filing

- Direct Deposit

- Time Tracking Integration

Limitations: Pricing requires detailed quote based on modules selected

Pros

- + Highly integrated platform (HR/IT/Finance)

- + Strong automation capabilities

- + Modern interface

- + Excellent for global teams

- + Good customization

Cons

- - Pricing is modular and can become expensive

- - Can be overkill for simple payroll needs

- - Requires commitment to their ecosystem for full value

Verdict

"A powerful, modern platform ideal for tech-savvy companies, especially those with global employees or needing strong HR/IT integration and automation."

User Reviews

Add Your Review

Loading reviews...

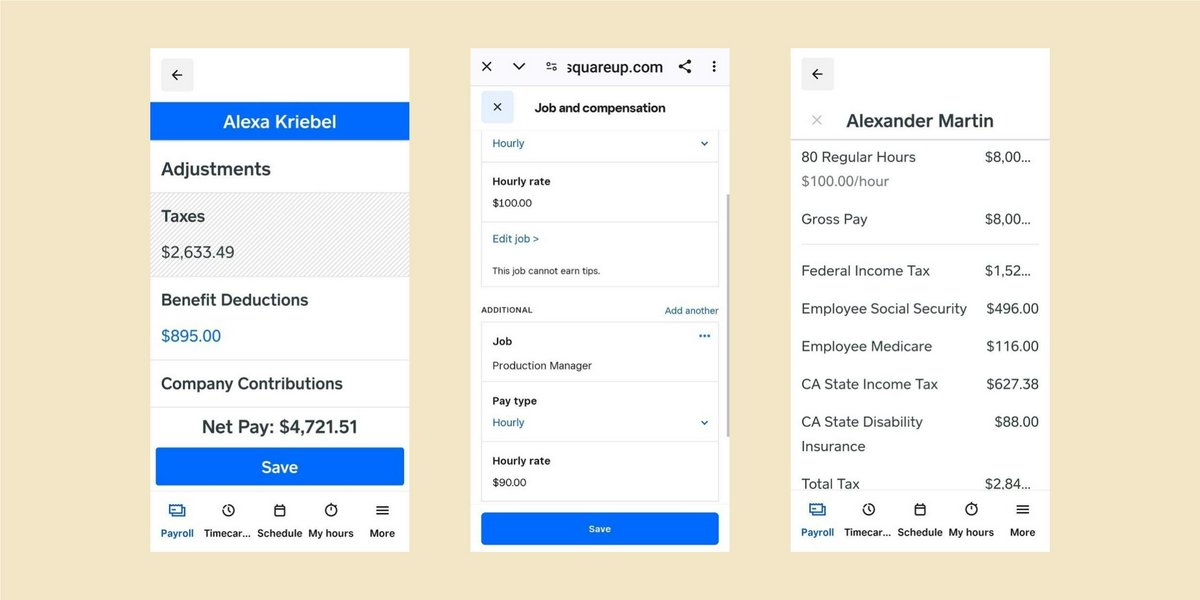

Square Payroll

By Square

Simple payroll service integrated with the Square POS and business ecosystem, designed for small businesses and retailers.

Platforms & Use Cases

Platforms: Web, Mobile (iOS/Android via Square Team App)

Best For: Small Business, Retailers, Restaurants, Square POS Users, Businesses paying contractors

Key Features

- ✓Square Ecosystem Integration: Syncs seamlessly with Square POS, timecards, and appointments.

- ✓Full-Service Payroll: Handles payroll runs, tax filings (W-2/1099), and direct deposit.

- ✓Contractor Payments: Offers a low-cost plan specifically for paying independent contractors.

- ✓Time Tracking: Integrates with Square timecards for easy hour import.

- ✓Employee App: Square Team App allows employees clock-in/out and view pay info.

Scorecard (Overall: 7.1 / 10.0)

Pricing

Pay Contractors Only

$6.00 / Monthly Per Person Paid

- 1099 e-filing

- Direct Deposit

- No base fee

Limitations: Only for 1099 contractors

Pay Employees & Contractors

$35.00 / Monthly + Per Person Paid Fee

- Full-service payroll

- Automated tax filings

- W-2 and 1099 support

- Multi-state payroll

- Timecard integration

- Basic benefits options

Limitations: Limited HR features, Benefits options basic

Pros

- + Excellent value, especially the contractor plan

- + Simple, easy-to-use interface

- + Seamless integration for Square users

- + Transparent pricing

Cons

- - Limited HR and benefits features

- - Not ideal for complex payroll needs or larger companies

- - Reporting is basic

Verdict

"A great value proposition for small businesses, especially those already using Square products or primarily needing to pay contractors."

User Reviews

Add Your Review

Loading reviews...

OnPay

By OnPay

All-inclusive payroll and HR service targeting small to medium businesses with straightforward, transparent pricing.

Platforms & Use Cases

Platforms: Web, Mobile (Web Optimized)

Best For: Small Business, Medium Business, Specific Industries (Farming, Restaurants, Nonprofits)

Key Features

- ✓Full-Service Payroll: Unlimited payroll runs, multi-state payroll, W-2/1099 processing, and tax filings.

- ✓Integrated HR Tools: Onboarding, offer letters, PTO management, compliance resources, and org charts included.

- ✓Benefits Integration: Integrates with benefits providers for health, dental, vision, and retirement plans.

- ✓Industry Specialization: Specific features and tax handling for industries like agriculture.

- ✓Direct Deposit & Pay Cards: Multiple payment options for employees.

Scorecard (Overall: 8.0 / 10.0)

Pricing

All-Inclusive Plan

$40.00 / Monthly + Per Employee Fee

- Full Payroll

- Tax Filing

- HR Tools (Onboarding, PTO, Docs)

- Benefits Integration

- Multi-state Payroll

- Reporting

Limitations: Mobile app is web-based, not native, Fewer integrations than some larger players

Pros

- + Simple, transparent, all-inclusive pricing

- + Good set of included HR features

- + Strong customer support reputation

- + Handles niche industry requirements well

Cons

- - Less scalable for very large enterprises

- - Fewer third-party integrations compared to leaders

- - No native mobile app

Verdict

"An excellent value for small to medium businesses seeking straightforward pricing with a solid bundle of payroll and HR features included."

User Reviews

Add Your Review

Loading reviews...

Paylocity

By Paylocity

Cloud-based HCM platform offering payroll, HR, talent management, and workforce management solutions primarily for mid-market companies.

Platforms & Use Cases

Platforms: Web, Mobile (iOS/Android)

Best For: Mid-size Business, Large Business

Key Features

- ✓Payroll Administration: Accurate payroll processing, tax services, garnishment management, and expense reimbursement.

- ✓Human Capital Management (HCM): Integrated suite including HR, benefits administration, talent acquisition, performance management, and compensation.

- ✓Workforce Management: Time & labor tracking, scheduling, and absence management.

- ✓Data Insights: Analytics and reporting tools for workforce trends and decision-making.

- ✓Employee Experience Tools: Self-service portal, mobile app, and communication tools (Community).

Scorecard (Overall: 8.0 / 10.0)

Pricing

Core Payroll & HR

Contact Vendor

- Payroll

- Tax Services

- HR Core

- Onboarding

- Self-Service

- Mobile App

Limitations: Pricing requires quote, Base package

Expanded HCM Suite

Contact Vendor

- Core features

- Benefits Admin

- Recruiting

- Performance

- Compensation

- Time & Labor

- Analytics

Limitations: Modular pricing adds up

Pros

- + Comprehensive HCM suite

- + Strong focus on employee experience and engagement

- + Good mobile app functionality

- + Scalable for mid-market growth

Cons

- - Pricing isn't transparent and requires a quote

- - Can be complex to implement and navigate

- - Customer support can be inconsistent

Verdict

"A robust HCM platform suited for mid-sized companies needing integrated payroll, HR, and talent management features with a focus on employee engagement."

User Reviews

Add Your Review

Loading reviews...

Final Thoughts

The payroll services market offers diverse solutions catering to different business sizes and needs. Leading platforms like ADP, Paychex, and Paylocity offer scalable, comprehensive HCM suites suitable for mid-to-large businesses but often come with complexity and quote-based pricing. Gusto excels in user-friendliness for SMBs, while QuickBooks Payroll is ideal for existing QuickBooks users. Rippling stands out for its integrated HR/IT approach and global capabilities, Square Payroll provides excellent value for small businesses (especially Square users), and OnPay offers transparent pricing with bundled HR features.

User Reviews

Add Your Review

Loading reviews...

No reviews yet. Be the first to share your thoughts!