Comprehensive Review of Leading Tax Software Options

By Richard "Rick" Callahan | Published: 2025-04-17 | Category: Tax Software

About Tax Software

Tax software provides digital tools for individuals and businesses to prepare and electronically file income tax returns. These applications guide users through tax forms, calculations, and deductions to ensure compliance and accuracy.

Scoring Criteria

- → Ease of Use

- → Feature Set

- → Accuracy & Guidance

- → Support Options

- → Pricing & Value

The Best Tax Software

#10

#10

OLT.com (Online Taxes)

By OnLine Taxes, Inc.

An authorized e-file provider offering a free federal option for simple returns and low-cost paid versions.

Platforms & Use Cases

Platforms: Web

Best For: Budget Filers, Simple Returns, Users needing basic forms

Key Features

- ✓Free Federal Edition: Free filing for filers meeting specific income/form requirements (often based on 1040EZ/simple 1040 criteria).

- ✓Premium Edition: Low-cost paid version supporting all forms and situations.

- ✓Low State Fee: Inexpensive state return filing.

Scorecard (Overall: 7.1 / 10.0)

Pricing

Free Edition

Contact Vendor

- Simple 1040

- W-2 income

Limitations: AGI limits often apply, restricted forms

Premium Edition

$9.95 / Per Federal Return

- All forms and schedules

- No income limits

State Return

$9.95 / Per State Return

- State tax filing

Pros

- + Very low cost for premium version

- + Free option for truly simple returns

- + Supports all forms in paid tier

- + Authorized e-file provider

Cons

- - Basic user interface

- - Limited guidance and support

- - Free version eligibility can be confusing

Verdict

"A budget-friendly option for filers comfortable with a no-frills experience, especially if they need forms beyond the simplest returns."

#9

#9

ezTaxReturn

By ezTaxReturn.com, Inc.

Focuses on fast and easy filing for simple to moderate returns at a low cost.

Platforms & Use Cases

Platforms: Web

Best For: Simple Returns, Budget Filers, Fast Filing Focus

Key Features

- ✓Fast Filing: Claims quick completion times for simple returns.

- ✓Low Cost: Affordable pricing for federal and state combined.

- ✓Accuracy Guarantee: Standard guarantee against calculation errors.

Scorecard (Overall: 6.7 / 10.0)

Pricing

Federal Simple

$31.00 / Per Return

- Basic 1040

- W-2 income

- Earned Income Credit

Limitations: Income limits apply, limited forms

Federal Basic Plus State

$39.00 / Per Return Bundle

- Federal Simple features

- State return included

Limitations: Restricted to simpler tax situations

Pros

- + Affordable bundled pricing

- + Designed for speed on simple returns

- + Easy for very basic filing needs

Cons

- - Very limited form support

- - Not suitable for complex situations (investments, self-employment)

- - Basic interface and guidance

- - Strict income/situation limitations

Verdict

"Suitable only for filers with extremely simple tax situations looking for a low-cost, quick online option."

User Reviews

Add Your Review

Loading reviews...

#8

#8

Liberty Tax Online

By Liberty Tax Service

Online tax filing from another major tax prep chain, offering basic to premium online options.

Platforms & Use Cases

Platforms: Web

Best For: Simple Returns, Moderate Returns, Brand Loyalists

Key Features

- ✓Accuracy Guarantee: Covers penalties and interest due to calculation errors.

- ✓Multi-Platform Access: Start online, finish in-office option.

- ✓Basic Needs Coverage: Handles common tax situations like W-2 income, dependents.

Scorecard (Overall: 6.6 / 10.0)

Pricing

Basic

$55.95 / Per Return

- Simple returns

- W-2 income

- Earned Income Credit

Deluxe

$75.95 / Per Return

- Basic features

- Itemized deductions

- HSA contributions

Premium

$95.95 / Per Return

- Deluxe features

- Rental income

- Investment income

Pros

- + Established brand name

- + Option for in-office support

- + Accuracy guarantee

Cons

- - Relatively expensive for the features offered

- - No free filing option

- - Interface feels dated

- - Less comprehensive than top competitors

Verdict

"Primarily for users already loyal to the Liberty Tax brand; other online options generally offer better value or features."

User Reviews

Add Your Review

Loading reviews...

#7

#7

Jackson Hewitt Online

By Jackson Hewitt Tax Service Inc.

Online version of the well-known tax preparation service, offering a DIY option alongside its physical locations.

Platforms & Use Cases

Platforms: Web

Best For: Simple Returns, Users preferring brand recognition, Potential for in-person switch

Key Features

- ✓Flat Rate Pricing: Simple pricing structure for federal returns.

- ✓Worry-Free Guarantee: Accuracy and maximum refund guarantees.

- ✓Physical Location Option: Ability to switch to in-person filing if needed.

- ✓Prior Year Import: Can import data from competitors.

Scorecard (Overall: 7.4 / 10.0)

Pricing

Federal Return

$25.00 / Per Return

- File federal taxes regardless of complexity

- Includes common forms

Limitations: State filing costs extra

State Return

$24.00 / Per State Return

- Prepare and file state taxes

Pros

- + Simple, flat-rate federal pricing

- + Backed by a large, established company

- + Option to utilize physical locations if DIY becomes overwhelming

Cons

- - Interface less modern than competitors

- - Fewer features compared to tiered products

- - Guidance can be basic

- - State filing cost adds up

Verdict

"A decent online option for those who trust the Jackson Hewitt brand or want a simple flat fee, but lacks the feature depth of others."

User Reviews

Add Your Review

Loading reviews...

#6

#6

Cash App Taxes

By Block, Inc. (formerly Square, Inc.)

Completely free tax filing service for both federal and state returns, integrated within the Cash App.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Simple Returns, Moderately Complex Returns, Cost-Conscious Filers, Mobile Filers

Key Features

- ✓Totally Free Filing: No charge for federal or state returns, regardless of complexity handled.

- ✓Mobile-First Design: Optimized experience for filing through the Cash App mobile application.

- ✓Audit Defense: Optional, paid audit defense service available.

- ✓Simple Interface: Clean, straightforward user experience.

Scorecard (Overall: 8.0 / 10.0)

Pricing

Free Filing

Contact Vendor

- Federal filing

- State filing

- Most common forms/schedules

Limitations: Does not support multi-state filing, certain uncommon forms/situations

Pros

- + Completely free for both federal and state

- + Easy-to-use mobile interface

- + Good for simple to moderate returns

- + No upselling

Cons

- - Requires using Cash App

- - Limited support options (primarily chat/email)

- - Does not support all complex tax situations or forms

- - Guidance is less comprehensive than paid options

Verdict

"An unbeatable free option for filers with relatively common tax situations who are comfortable with a mobile-centric experience and minimal support."

User Reviews

Add Your Review

Loading reviews...

#5

#5

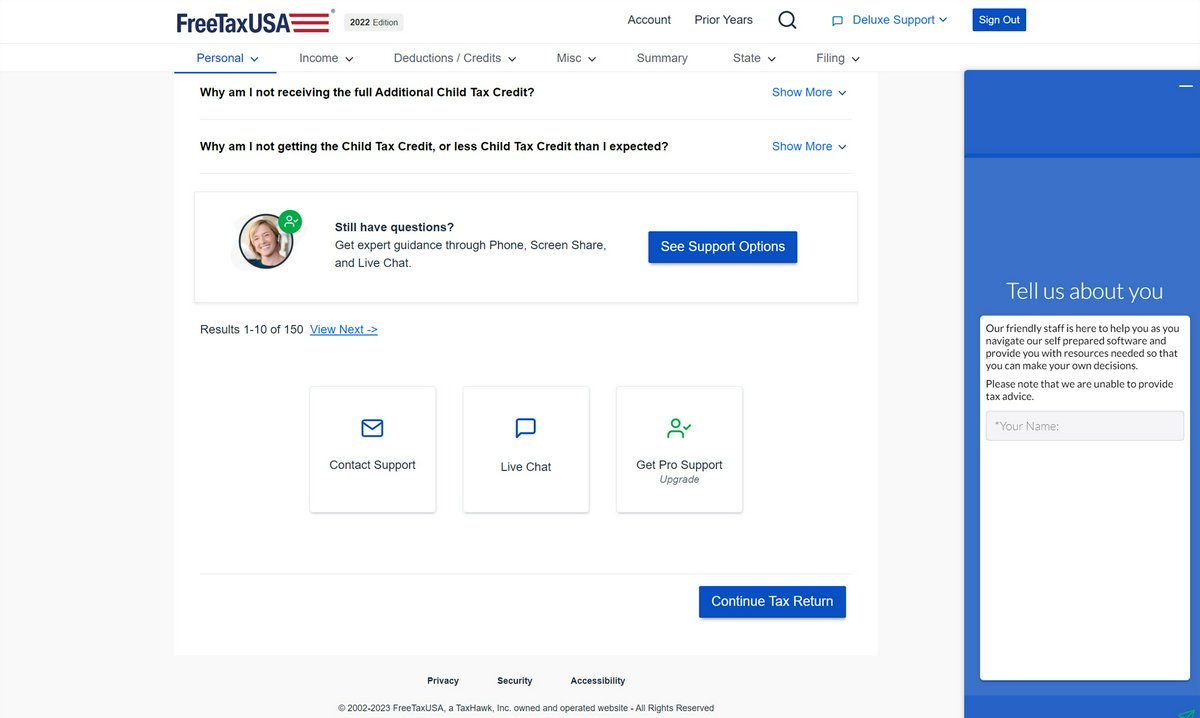

FreeTaxUSA

By TaxHawk, Inc.

Offers free federal filing for all situations, charging only for state returns and optional deluxe services.

Platforms & Use Cases

Platforms: Web

Best For: Budget Filers, Complex Returns, All income types

Key Features

- ✓Free Federal Filing: Supports all major forms and schedules for federal returns at no cost.

- ✓Low-Cost State Filing: State returns available for a flat, inexpensive fee.

- ✓Deluxe Add-on: Optional upgrade for priority support, audit assist, and unlimited amended returns.

- ✓Prior Year Import: Imports data from previous returns filed with FreeTaxUSA or competitors.

Scorecard (Overall: 8.3 / 10.0)

Pricing

Free

Contact Vendor

- All federal forms/schedules

- Itemized deductions

- Investment/business income

Limitations: State filing costs extra, Basic support

Deluxe

$7.99 / Add-on

- Priority live chat support

- Audit Assist

- Unlimited amended returns

State Return

$14.99 / Per State Return

- Complete state tax preparation and filing

Pros

- + Free federal filing for all situations

- + Handles complex returns (investments, self-employment) for free

- + Extremely affordable state filing

- + Straightforward, no-frills interface

Cons

- - Interface is functional but basic

- - Limited guidance compared to premium products

- - Support options are minimal without Deluxe upgrade

- - No downloadable software version

Verdict

"The best value for filers comfortable navigating tax forms with less hand-holding, regardless of complexity."

User Reviews

Add Your Review

Loading reviews...

#4

#4

TaxSlayer

By TaxSlayer LLC

Affordable online tax prep with a straightforward interface, particularly good for self-employed filers.

Platforms & Use Cases

Platforms: Web, iOS, Android

Best For: Budget Filers, Simple Returns, Self-Employed, Military Personnel

Key Features

- ✓Competitive Pricing: Lower costs across all tiers compared to major brands.

- ✓All Forms Included Option: Premium/Self-Employed tiers include access to all major forms.

- ✓Military Discounts: Offers free federal filing for active duty military.

- ✓Audit Assistance: Provides support in navigating IRS notices.

Scorecard (Overall: 8.1 / 10.0)

Pricing

Simply Free

Contact Vendor

- Basic 1040 return

- W-2 income

Limitations: Taxable income limit, no dependents for free version sometimes

Classic

$37.95 / Per Return

- All credits/deductions supported

- Includes dependents

Premium

$57.95 / Per Return

- Classic features

- Priority support

- Ask a Tax Pro help

- Audit assistance

Self-Employed

$67.95 / Per Return

- Premium features

- Specific guidance for 1099/Schedule C

- Estimated tax payment reminders

Pros

- + Very competitive pricing

- + Good value, especially for self-employed

- + Relatively easy to navigate

- + Free option for active military

Cons

- - Interface less sophisticated than top tiers

- - Support options can be limited on lower tiers

- - Guidance less detailed than some competitors

Verdict

"Excellent choice for budget-conscious filers, particularly those with self-employment income."

User Reviews

Add Your Review

Loading reviews...

#3

#3

TaxAct

By TaxAct Holdings, Inc.

Value-focused software offering comprehensive features at a lower price point than top competitors.

Platforms & Use Cases

Platforms: Web, Windows, iOS, Android

Best For: Cost-Conscious Filers, Simple to Complex Returns, Investors, Self-Employed

Key Features

- ✓Price Lock Guarantee: Ensures the price you start with is the price you pay when filing.

- ✓$100k Accuracy Guarantee: Covers software errors up to $100,000.

- ✓Pro Tips and Planning: Offers insights and tools for future tax planning.

- ✓Data Import: Supports importing prior year returns and financial data.

Scorecard (Overall: 8.2 / 10.0)

Pricing

Free

Contact Vendor

- Simple 1040 returns

- W-2 income

- Unemployment

Limitations: Very basic returns only

Deluxe

$49.99 / Per Return

- Free features

- Itemized deductions

- Child tax credits

- Student loan interest

Premier

$69.99 / Per Return

- Deluxe features

- Investment income

- Rental property

- Foreign bank accounts

Self-Employed

$99.99 / Per Return

- Premier features

- Freelance/Schedule C income

- Personalized business deductions

Pros

- + More affordable than TurboTax/H&R Block

- + Comprehensive form support in paid versions

- + Price lock guarantee

- + Accuracy guarantee

Cons

- - Interface not as polished as top competitors

- - Support options less robust

- - Upselling present

Verdict

"A strong value proposition for filers needing advanced forms without the highest price tag."

User Reviews

Add Your Review

Loading reviews...

#2

#2

H&R Block

By H&R Block

Strong competitor with online and downloadable versions, plus physical branch support.

Platforms & Use Cases

Platforms: Web, Windows, macOS, iOS, Android

Best For: Simple Returns, Complex Returns, Self-Employed, Investors, Users wanting in-person support option

Key Features

- ✓Multiple Filing Options: Online, downloadable software, or in-person filing.

- ✓Data Import: Imports financial data and competitor tax returns.

- ✓Expert Review: Option to have a tax pro review your return before filing.

- ✓Physical Office Network: Access to support and filing assistance at H&R Block locations.

Scorecard (Overall: 8.6 / 10.0)

Pricing

Free Online

Contact Vendor

- Simple returns

- W-2 income

- Unemployment income

Limitations: Limited forms, often requires upgrade for deductions/credits

Deluxe

$55.00 / Per Return

- Free features

- HSA support

- Itemized deductions

Premium

$75.00 / Per Return

- Deluxe features

- Freelancer/contractor income (Schedule C-EZ)

- Investment income

Self-Employed

$115.00 / Per Return

- Premium features

- Full Schedule C support

- Business expense tracking

Pros

- + User-friendly interface

- + Strong feature set across versions

- + Option for in-person support

- + Competitive pricing compared to TurboTax

Cons

- - Free version limitations

- - Upselling can be persistent

- - Software support costs extra for lower tiers

Verdict

"A robust alternative to TurboTax, especially valuable for those who might want the option of in-person assistance."

User Reviews

Add Your Review

Loading reviews...

View Top Ranked Software

Watch a short ad to unlock the details for the #1 ranked software.

#1

#1

TurboTax

By Intuit

Popular, user-friendly software known for its interview-style process and comprehensive support.

Platforms & Use Cases

Platforms: Web, Windows, macOS, iOS, Android

Best For: Simple Returns, Complex Returns, Self-Employed, Investors, Rental Property Owners

Key Features

- ✓Guided Interview: Q&A format simplifies tax form completion.

- ✓Data Import: Imports W-2s, 1099s, and previous year's data.

- ✓Audit Support Guarantee: Provides guidance and representation options in case of an audit.

- ✓Live Tax Expert Assistance: Option to connect with a credentialed tax professional (additional cost).

Scorecard (Overall: 8.8 / 10.0)

Pricing

Free Edition

Contact Vendor

- Simple tax situations (1040 only)

- W-2 income

- Standard deduction

Limitations: No itemized deductions, schedules 1-3 often require upgrade

Deluxe

$69.00 / Per Return

- Free Edition features

- Itemized deductions (Schedule A)

- Mortgage/property tax deductions

Premier

$99.00 / Per Return

- Deluxe features

- Investment/rental property income (Schedule D, E)

- Crypto transactions

Self-Employed

$129.00 / Per Return

- Premier features

- Guidance for freelancers/contractors (Schedule C)

- Expense tracking

Pros

- + Extremely user-friendly interface

- + Comprehensive guidance and explanations

- + Strong import capabilities

- + Excellent support options including live help

Cons

- - Most expensive option

- - Frequent upselling prompts

- - Free version is very limited

Verdict

"Best for users prioritizing ease-of-use and extensive support, willing to pay a premium."

User Reviews

Add Your Review

Loading reviews...

Final Thoughts

The tax software market offers a wide range of options, from high-support, premium-priced products like TurboTax and H&R Block to exceptional value propositions like FreeTaxUSA and Cash App Taxes. Ease of use, comprehensiveness of forms, available support, and price are key differentiators. Users should choose based on their individual tax complexity, budget, and desired level of guidance.

User Reviews

Add Your Review

Loading reviews...

No reviews yet. Be the first to share your thoughts!